By: Jennifer Turner, Senior Consultant

When evaluating a new prospect, one of the first places I look is at their real estate assets. After all, the Capgemini/Merrill Lynch World Wealth Report makes it seem easy:

The Capgemini/Merrill Lynch World Wealth Report provides evidence that real estate comprises approximately 19 percent of high-net-worth individuals’ total assets.

So, if you’re like me, you cringe when you realize a prospect lives in a rental unit or does not have any real estate assets of their own. Similarly, what about those prospects who live in an assisted living facility? Does this mean they are not good prospects because their money is being consumed by the facility? Or, on the contrary, does it mean the prospect is quite wealthy because they have the means to live in what might be considered a “luxury” nursing home? Arguments can be made for both sides of the spectrum.

The reality is there’s no Capgemini-style equation for estimating a nursing home resident’s capacity. But that doesn’t mean we have to stop here. What we can do is provide meaningful context to indicate whether or not a prospect is worth pursuing – albeit without the assignment of a numerical rating.

But first let’s look at some important terms:

Nursing home vs. assisted living

According to the website A Place for Mom, assisted living communities help with the activities of daily living, such as bathing, toileting, dressing, while nursing homes provide 24-hour monitoring and medical care (deeming it the highest level of health care offered outside of a hospital setting). The national median monthly cost of assisted living is $5,190, while the national median monthly cost of a nursing home is $10,646 according to CareScout’s 2025 Cost of care survey.

Medicaid vs Medicare

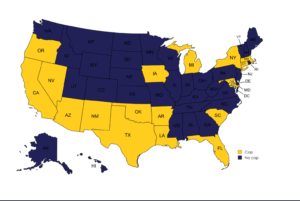

Medicare is a federal health insurance program for people age 65 and older that typically only covers limited short-term nursing home stays for rehabilitation after a hospitalization. For ongoing long-term care costs, Medicaid can serve as a primary payer. However, unlike Medicare, eligibility depends on meeting strict income and asset limits. Rules vary by state, but most limit individuals to no more than $2,000 in countable assets. While we cannot tell from our own research if a prospect is on Medicaid, should the term happen to come up in their conversation with a gift officer, most likely they do not have significant wealth (and therefore should not be pursued for a gift).

Factors to consider when evaluating a nursing home or assisted living resident as a prospect:

- The nursing home/assisted living facility itself – is it “luxury” housing or is it considered “affordable senior housing”?

- What was the prospect’s lifestyle prior to moving into the nursing home? You may not be able to use current assets to calculate a rating, but if you take a step back and examine their lifestyle before becoming a resident, you may be able to get a sense of their wealth.

- Career history – most nursing home residents are retired, but what did the prospect do for a living? If you are lucky enough to learn that they worked at a public company, you may be able to find the details of his or her retirement package.

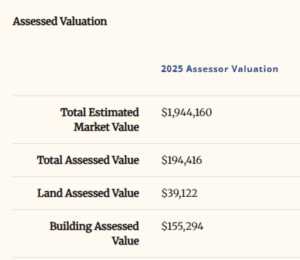

- Did they recently sell their home? And for how much?

- Giving history – are they still giving? Has their giving stopped since moving into the nursing home?

- Do they/did they have a foundation?

Caveats:

- They may have already settled their affairs (did you notice any recent planned gifts during your search for gifts?)

- Some of their assets may have been transferred to their children, so if you think they may still own that second home in Florida, but can’t find it under their name, check their children’s real estate holdings.

- According to the 2016 study “Later-Life Household Wealth Before and After Disability Onset” by Richard W. Johnson, people who spent at least 90 days in a nursing home had 86 percent less total household wealth and 96 percent less housing wealth within two years of entry than their counterparts who did not experience extended nursing home care. Therefore, if you are going to consider a nursing home resident a potential prospect, you may want to bump them up to the top of you visit list (before nursing home costs consume their assets). Perhaps they are looking to spend their money in other, more rewarding ways, such as a gift to their favorite nonprofit organization.

Conclusion:

While we cannot use nursing home residency to assess a prospect’s capacity, we can still get a sense of whether or not they are a viable prospect, we just need to think outside the box a bit and take other factors into consideration. While we may have to be content knowing that we will never find their true capacity, it is our job as diligent researchers to at least provide our gift officers with as much context as possible.

Finally, don’t forget their children! Just because the resident may not be a prospect, don’t rule out their family. After all, what better way to honor the memory of one’s parent than by making a gift in their name to your organization?

Sources:

https://www.aplaceformom.com/caregiver-resources/articles/assisted-living-vs-nursing-homes

https://www.carescout.com/cost-of-care

https://aspe.hhs.gov/sites/default/files/migrated_legacy_files//171881/householdwealth.pdf

Let’s channel Paul Simon for a moment and talk about shoes. That’s probably not the lead-in that you expect from a blog post that’s supposed to be about philanthropy. But, I promise you it is!

Let’s channel Paul Simon for a moment and talk about shoes. That’s probably not the lead-in that you expect from a blog post that’s supposed to be about philanthropy. But, I promise you it is!