One thing that’s great about our profession is that we get to learn a little bit about a lot of things. Sometimes, though, the learning is more of a slog than we’d like. This week HBG Senior Consultant Heather Hoke forges a path for us through the dense mire of SEC Form ADVs, so that we can get better information about financial advisors and the companies they work for. Thanks, Heather! ~Helen

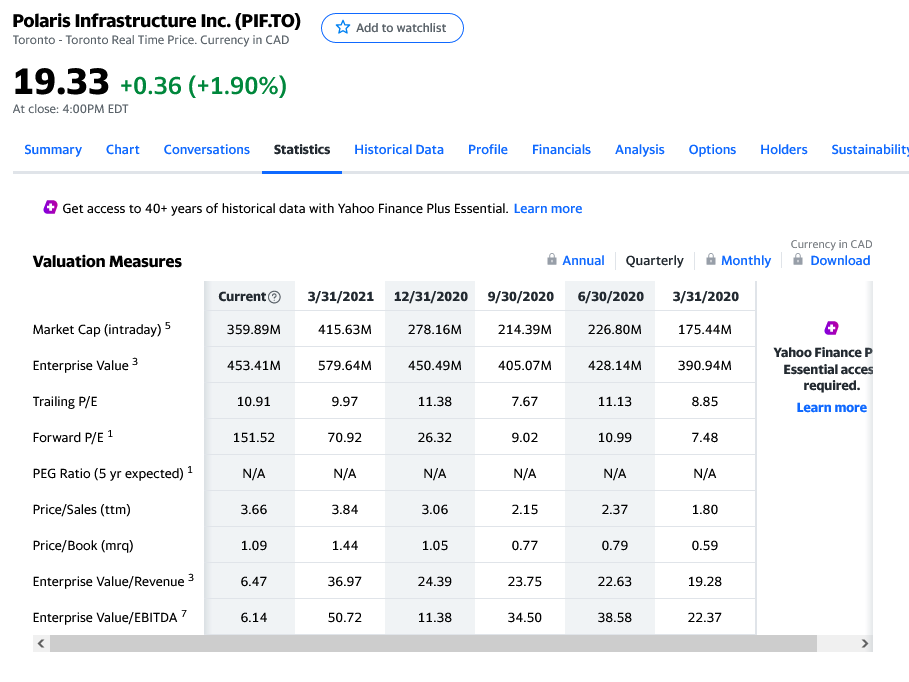

There is so much wealth among people in the finance industry. If you are researching someone who is a founder, partner, or executive officer of an advisory firm, including private equity and hedge funds, be sure to look at the SEC Form ADV. It provides an abundance of information about registered investment advisory firms and their affiliated professionals.

I remember when I first started looking at Form ADVs and I felt completely overwhelmed! There were so many pages of information, sometimes hundreds of pages. Well, that was many years ago and I am now much more adept at finding the information that I need quickly. I thought I would share some tips with you to save you some time…

The Securities and Exchange Commission (SEC) requires all professional investment advisers to submit the Uniform Application for Investment Adviser Registration (or more commonly known as the Form ADV). For companies that manage funds in excess of $25 million, this form must be updated annually and whenever material changes occur.

Where to find a Form ADV

Form ADVs are publicly available through the SEC’s Investment Advisor Public Disclosure website. There you can search either by advisory firm name or by the name of the individual investment advisor.

For our work, the two most important things to look at are “View Form ADV By Section” and “Part 2 Brochures.”

Choose “View Form ADV By Section” so that it is broken down into sections to view rather than the full, often very lengthy, document.

Sections not to miss

Part 1A Item 1 Identifying Information includes the name, address and phone number of the investment advisor.

Item 2 SEC Registration/Reporting specifies if the firm is considered a large or mid-sized advisory firm.

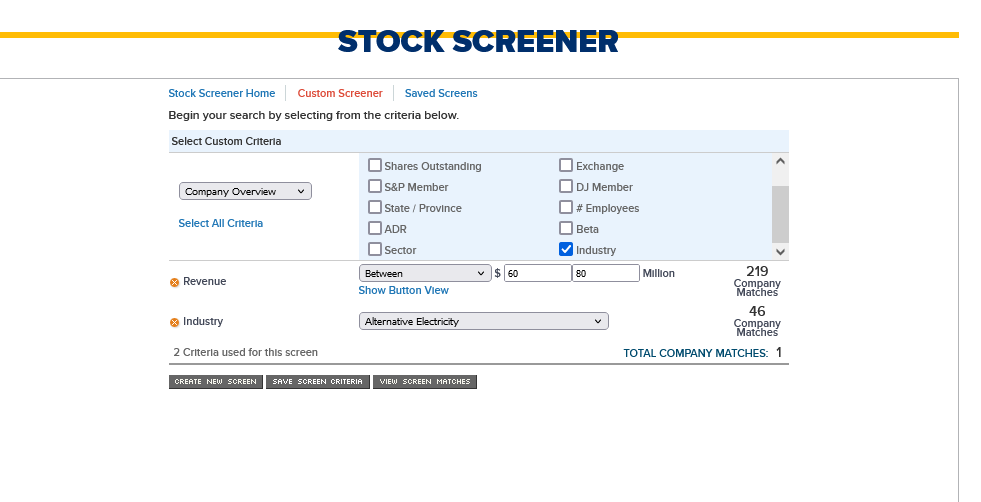

Item 5 Information About Your Advisory Business provides number of employees (in sections A and B), number and types of clients (in sections C and D), fee arrangements (in section E), assets under management (AUM) (in sections D and F), and advisory activities (in section G).

Schedule A includes direct owners of the registered investment advisor with a 5% or more ownership interest and executive officers (CEO, chief financial officer, chief operating officer, chief legal officer, chief compliance officer, directors).

Schedule B includes all of the indirect owners.

It is necessary to check both Schedule A and Schedule B to fully understand the ownership structure and ranges. Ownership codes specify a range of ownership interest which can be helpful in considering the capacity of an individual.

Schedule D includes other office locations and affiliated registered investment advisors and broker/dealers.

Disciplinary Reporting Page (DRP) provides details about felony or investment-related misdemeanor, regulatory discipline, or court judgments related to violation of investment-related statutes and regulations by the investment advisor or its affiliated persons.

Signature Page for the date of the document.

Next choose “Part 2 Brochures.” At the bottom of the page, you will find a PDF of the brochure which is a narrative of the advisory firm. Each firm lays out their brochure slightly differently, but there is a table of contents to help you find relevant sections. The document can include:

- An overview of the registered investment advisor

- Advisory fees

- Types of clients

- Background information on advisors

- Disciplinary information of any legal or disciplinary events

Now you’re a pro at deciphering the SEC Form ADV!

The information in the ADV can be incredibly helpful when researching people in the finance industry or an advisory firm as it can provide indications of significant wealth for individuals and be useful in your due diligence research.